What Information Do You Need To File For Unemployment

If you file for a. Add in information about your employment in the last year and a half.

Requirements may vary from state to state but heres a sampling of the information you will need to have available when filing for unemployment.

What information do you need to file for unemployment. When you file a claim you will be asked for certain information such as addresses and dates of your former employment. Your complete mailing address including street city state and zip code. Your Social Security number.

To qualify for Unemployment Insurance benefits you must have worked and earned enough wages in covered employment. If you worked in a state other than the one where you now live or if you worked in multiple states the state unemployment insurance agency where you now live can provide information about how to file your claim with other states. Keep a record of who you spoke with and when.

To make sure your claim is not delayed be sure. Your drivers license or state ID card number if you have one. You will also need to provide information on all the employers you worked for within the past 18 months.

Pension information if you are receiving any pension or 401k Amount and duration of any separation pay you may be receiving. Here are steps that can help you protect your finances and your credit. Your 1099-G will have the information youll need to transfer to your tax return.

Report the fraud to your state unemployment benefits agency. You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount. Fill in information about your employers including contact information your pay and the dates you worked there.

First and last dates month day and year you worked for your last employer. Depending on the state claims may be filed in person by telephone or online. The above information will be more than enough to obtain credit in your name access personal financial accounts and even file a.

Regular Unemployment People who are on regular UI claims are required to apply for a new claim at the end of their benefit year. Gather the following information. Employment Data Have ready the payroll addresses and names of any employer youve had for at least the past 18 months you usually need to list this information on your application form.

You can apply for unemployment benefits online -- just create an account on the NJ Department of Labors website. Your NJ drivers license or NJ non-driver identification number. Your last employers business name address and phone number.

You will need to provide your complete work history for the past 18 months including employer names addresses phone numbers and dates of employment. There are two ways to qualify. Report the fraud to your employer.

Alien Registration Number if you are not a US citizen. The fraudulent unemployment claim may only be the beginning. To submit the application just hit the button at the bottom of the page.

In New York State employers pay contributions that fund Unemployment Insurance. Youll have to pay taxes on the remaining amount if you received more than 10200 in unemployment compensation. Contact your states unemployment insurance program for more information and to apply for benefits.

Youve been paid at least 1000 in subject wages in your base year and. Youll also need to list why youre not working at each position anymore. How do I qualify.

Information You Need to Apply. The federal government has allowed states to change their laws to provide COVID unemployment benefits for people whose jobs have been affected by the coronavirus pandemic. The American Rescue Plan Act of 2021 authorizes.

When you file for unemployment the SUI representatives may need to conduct a brief phone interview to confirm the facts on your application. If you worked for your last employer on more than one occasion provide the most recent employment dates. Due to a high volume of claims right now theres a.

To receive unemployment insurance benefits you need to file a claim with the unemployment insurance program in the state where you worked. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax. You should contact your states unemployment insurance program as soon as possible after becoming unemployed.

This should include the name of the employer address dates of employment wages earned hours worked per week and the reason you are no longer in the job.

Filing For Unemployment Benefits In Illinois And Encountering Issues Try These Tips During The Coronavirus Crisis Abc7 Chicago

Filing For Unemployment Benefits In Illinois And Encountering Issues Try These Tips During The Coronavirus Crisis Abc7 Chicago

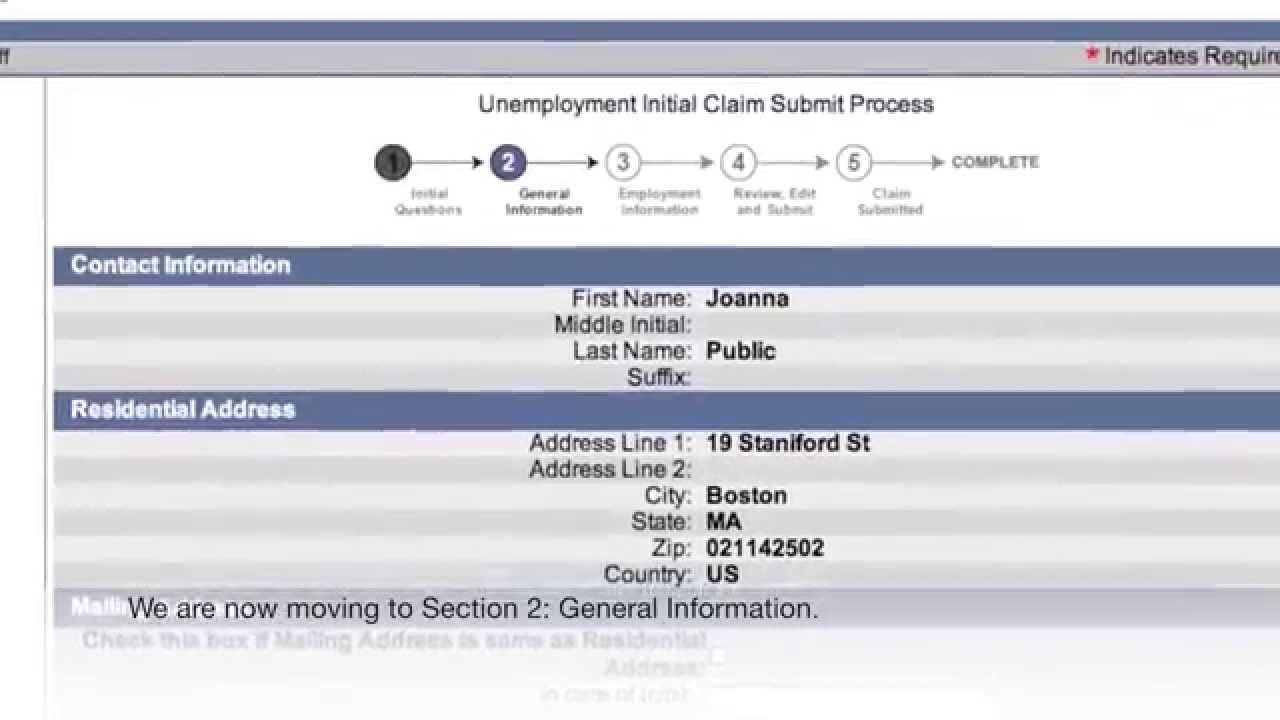

Applying For Unemployment Benefits Mass Gov

Applying For Unemployment Benefits Mass Gov

Nevada Coronavirus Layoffs How To File For Unemployment Insurance

Nevada Coronavirus Layoffs How To File For Unemployment Insurance

How To File For Unemployment In California During The Coronavirus Pandemic Kqed

How To File For Unemployment In California During The Coronavirus Pandemic Kqed

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png) How To Calculate Your Unemployment Benefits

How To Calculate Your Unemployment Benefits

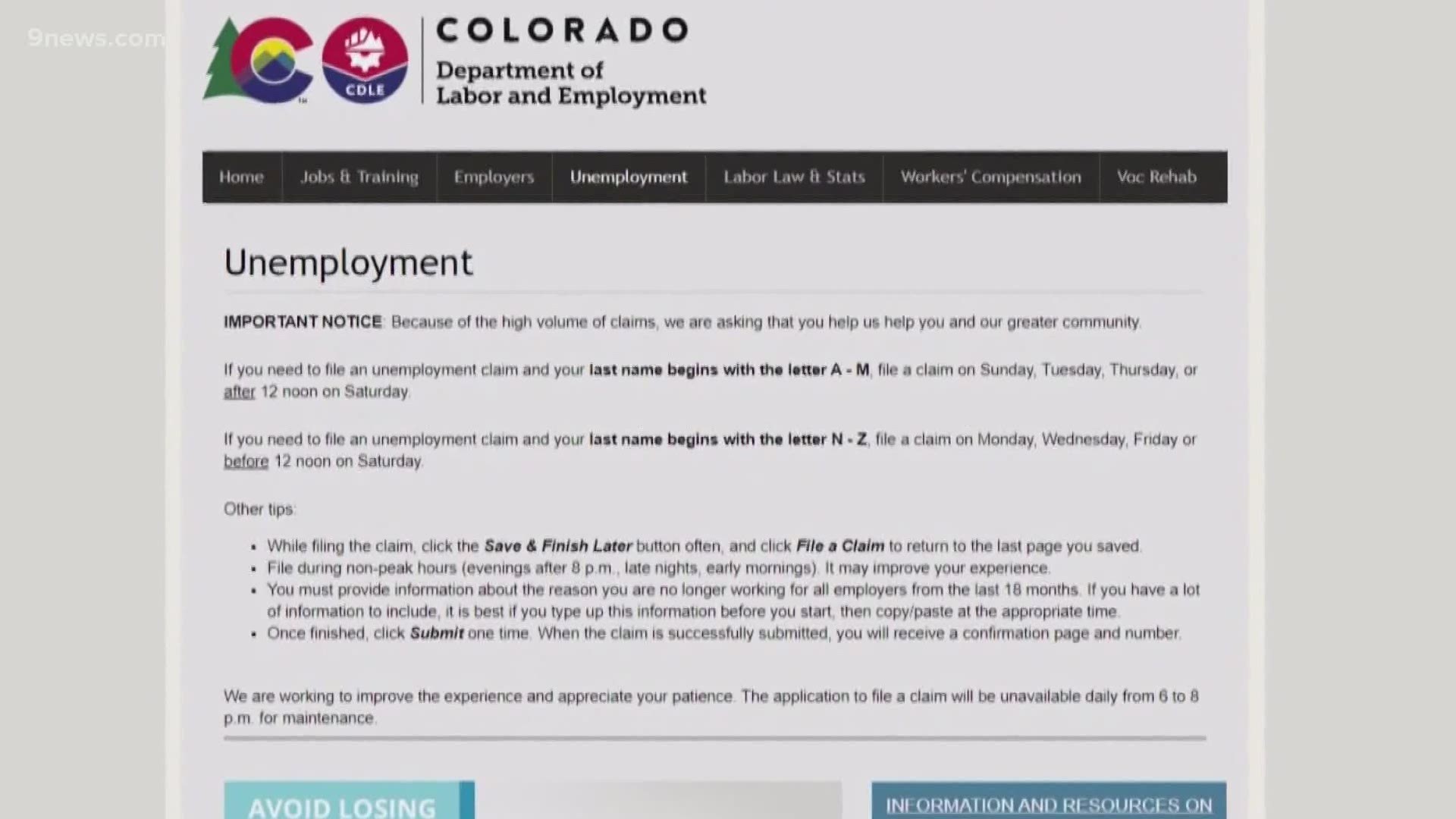

Here S How Colorado Self Employed Can Apply For Unemployment 9news Com

Here S How Colorado Self Employed Can Apply For Unemployment 9news Com

:max_bytes(150000):strip_icc()/how-to-file-for-unemployment-benefits-online-2064123-finalv3-ct-648bbcd2cf1b43e59ef01b98b09bf82d.png) How To File For Unemployment Benefits

How To File For Unemployment Benefits

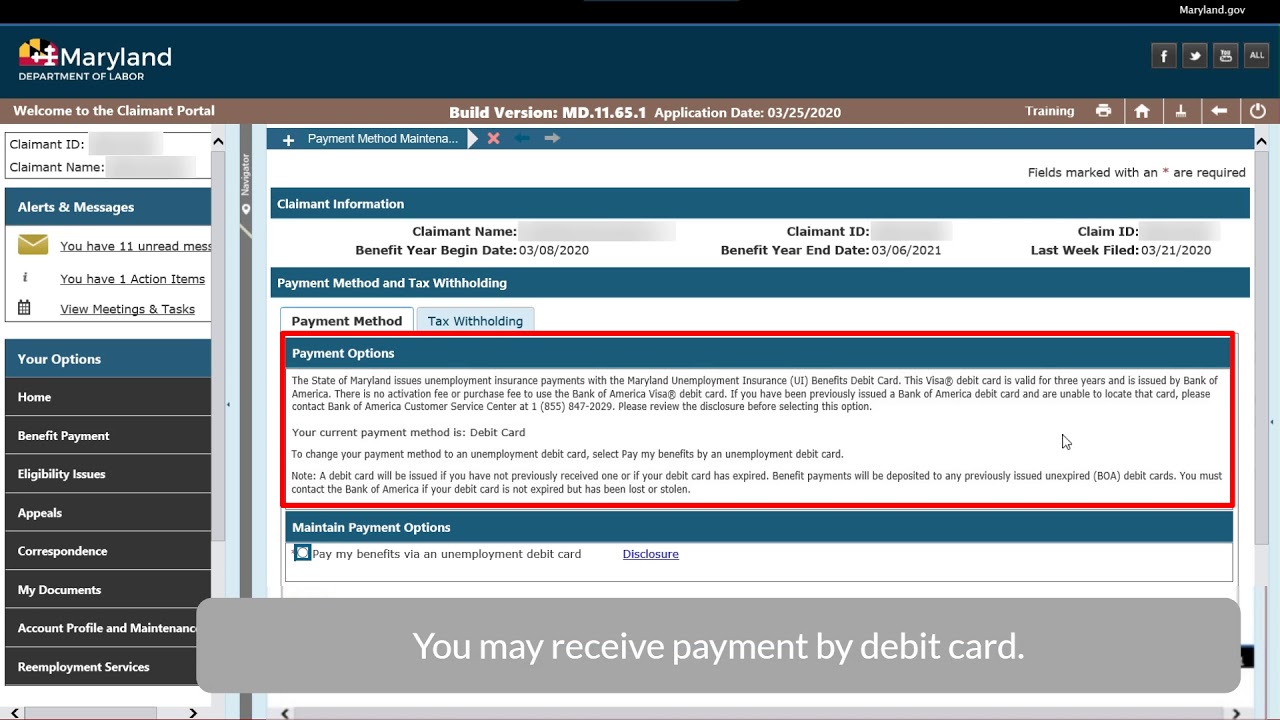

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

How To Apply For Unemployment Benefits Daveramsey Com

How To Apply For Unemployment Benefits Daveramsey Com

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

How To File A Claim For Unemployment Youtube

How To File A Claim For Unemployment Youtube

Comments

Post a Comment